Last year was an outlier in many ways for the corn market, and not only because farmers harvested a record-shattering 17 billion bushels.

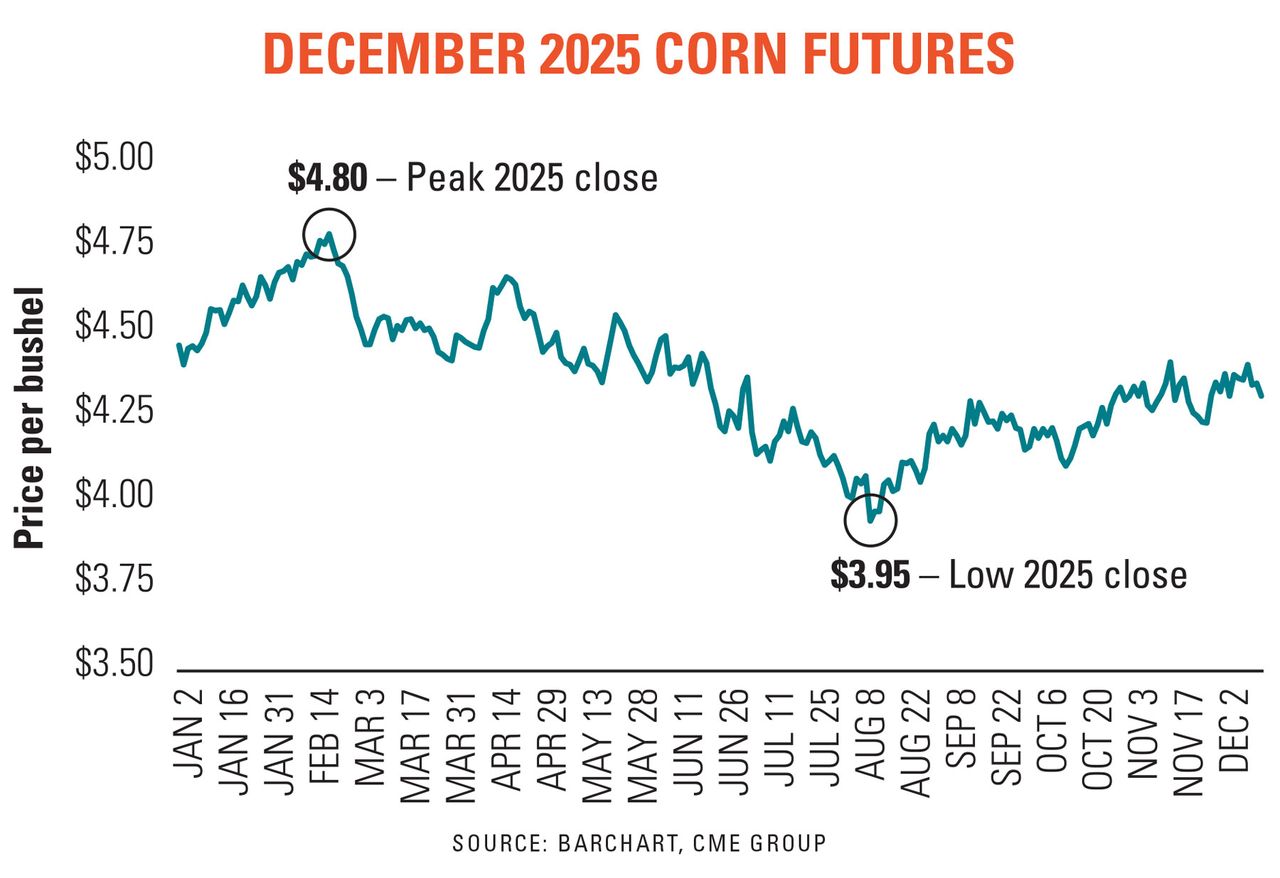

On Feb. 19 a year ago, December 2025 corn contract established what turned out to be a peak at just under $4.80 per bushel. It was mostly downhill from there until late August, when the market bounced back from a brief dip under $4 before ending the year around $4.31.

Based on recent market history, such an early-year peak in the new crop contract is unusual: 2025 was the only year in the past decade in which the December corn contract established its high for its corresponding calendar year in February. Over that period, May (2018, 2021, 2022) and June (2016, 2019, 2023) were the most common peak-price months. (In 2020, December futures actually did peak in the expiration month.)

This raises a critical question for corn farmers and their marketing strategies: Was last year really an outlier? Or was it a harbinger? USDA’s bearish January bombshell throws even greater uncertainty into the outlook, offering another reason to wonder whether the early months may bring the best prices you’ll likely see.

With spring planting season a few months away and decisions on acreage mix still likely in flux, pricing new crop harvest might be one of the last things farmers want to think about. But 2026 might be another year when the early months bring the best prices you’ll likely see.

One we’ll call the “2-handle” effect, referring to USDA’s outlook for U.S. corn stockpiles at the end of the 2025-26 marketing year Aug. 31 to balloon to a seven-year high at 2.23 billion bushels, up 44% from last year. While corn demand is running at a record pace, will it be enough to soak up enough excess supplies to build a farmer-friendlier price structure?

To double down on the 2-handle: What if the market has back-to-back years with corn carryouts north of 2 billion bushels?

It could easily happen. Even if U.S. farmers scale back corn plantings from last year’s nine-decade high, as widely expected, will it be enough to put a dent in the supply mountain? A relatively aggressive reduction of roughly 5% — say, to under 94 million acres — could still lead to a crop above 15 billion bushels with favorable weather and yields above 180 bu/acre. Throw in another big crop in Brazil this year, and it’s hard to build a bullish supply-driven case, absent a severe Midwest drought this summer.

The Trump Administration’s $12 billion Farm Bridge Assistance emergency aid program announced in December further muddies the picture, perhaps ultimately resulting in more corn acres than market conditions would seem to dictate. Corn’s per-acre payout under the FBA, at $44.36 per acre, is higher than that for both soybeans and wheat.

This isn’t to say the 2026 market will be a “Groundhog Day” version of 2025 or any other year. It may take months to get a handle on the longer-term implications of USDA’s jaw-dropping January, in terms of price structure, acreage mix and other factors. Spring and summer weather scares can and will happen. But the initial take bodes poorly for bulls. (December 2026 corn sank to about $4.45 in the wake of USDA’s January reports.)

In the early days of another big supply year, market rallies could prove to be much like subterranean rodents: Elusive and tough to catch.