Grain prices were lightly mixed immediately following the February World Agricultural Supply and Demand Estimates report from USDA as traders assessed the fresh set of data points. Corn prices found modest gains Tuesday morning after USDA lowered ending stocks by 100 million bushels. Soybeans moved modestly higher, meantime, while winter wheat prices faced mild to moderate cuts.

Soybean futures briefly spiked lower after USDA’s upward revision to global supplies exceeded expectations but quickly bounced back and sustained firm gains into late trading. Near midday, March soybeans rose 9.25 cents to $11.20 per bushel and were poised to close at the contract’s highest price since early December. Corn and wheat futures had limited reaction to the numbers. March corn was up 0.75 cent to $4.2925, while March SRW wheat was down 1.25 cents to $5.2750.

Corn

Corn ending stocks shifted 100 million bushels lower, to 2.127 billion bushels. Analysts were expecting no change from January, meantime, with an average trade guess of 2.227 billion bushels.

USDA also noted: “Export sales and inspection data continued to show robust foreign demand during January and imply total shipments during the September-January period will most likely exceed 1.3 billion bushels.” The agency left the season-average farm price unchanged, at $4.10 per bushel.

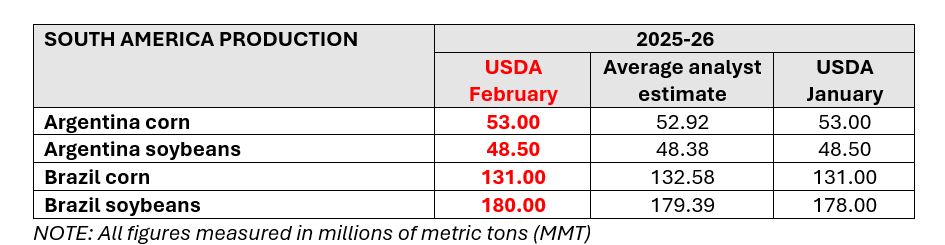

In South America, USDA made no corn production changes, with Argentina staying at 2.087 billion bushels and Brazil holding steady at 5.157 billion bushels. Analysts were expecting a fractional decrease for Argentina and a moderate increase for Brazil.

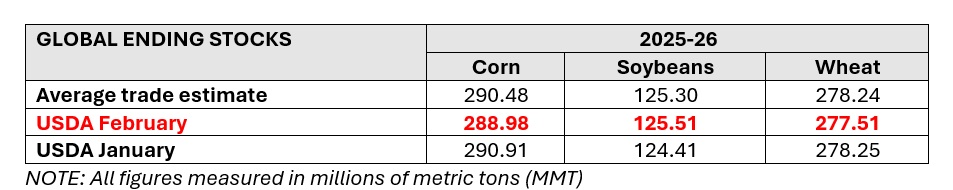

Global ending stocks eased from 290.91 million metric tons in January down to 288.98 MMT. Analysts were anticipating a more modest drop after offering an average trade guess of 290.48 MMT.

Soybeans

USDA made no changes to its soybean supply and use projections for February. Ending stocks were steady, at 350 million bushels, with analysts expecting a modest decrease to 347 million bushels.

The season-average farm price also held steady for the soy complex. Soybean prices remain at $10.20 per bushel, with soymeal prices at $295 per short ton and soyoil prices at 53 cents per pound.

In South America, USDA bumped up its estimates for Brazil’s soybean production potential to 6.614 billion bushels. Most other entities are also anticipating that production will crest 6.6 billion in 2025-26. That would also be a year-over-year increase of nearly 5%, if realized. Argentina’s soybean production estimate held steady, at 1.782 billion bushels.

Globally, USDA raised ending stocks from 124.41 MMT in January up to 125.51 MMT. That was slightly higher than the average trade guess of 125.30 MMT.

Wheat

USDA noted “unchanged supplies, modestly lower domestic use, unchanged exports and slightly higher ending stocks” for wheat. Ending stocks increased to 931 million bushels, which is 9% higher-year-over year and at the highest levels since 2019-20. The projected season-average farm price was unchanged, at $4.90 per bushel.

World ending stocks ticked slightly lower, moving from 278.25 MMT in January down to 277.51 MMT. Analysts were only expecting a fractional decline, with an average trade guess of 278.24 MMT. Despite the drop, global ending stocks remain at a five-year high.

Of particular note regarding overseas production, Argentina is expected to reap a record-breaking crop this season, with 1.021 billion bushels. Argentina and Australia are the only two significant wheat exporters in the Southern Hemisphere.