Under the India-European Union Free Trade Agreement concluded last month, Indian trade negotiators had also sought easier access to steel scrap produced in the 27-nation EU as a workaround to soften the impact of the carbon border adjustment mechanism (CBAM).

The EU’s CBAM, which came into effect in January 2026, aims to impose a carbon tariff on the greenhouse gases emitted during the production of certain carbon-intensive goods, including iron, steel and fertilizers. This raises concerns among Indian steel producers, as iron and steel account for 90 per cent of all the CBAM-exposed Indian goods exports to the EU.

Against this backdrop, India’s emphasis on increasing scrap share in steel making aligns with its green steel initiative and emerging global sustainability norms. But what is green steel, and what challenges does India face in transitioning to greener solutions in steel manufacturing?

What is green steel?

In December 2024, India became the first country to define green steel in its Green Steel Taxonomy. According to the taxonomy, “Green Steel shall be defined in terms of the percentage greenness of the steel, which is produced from the steel plant with CO₂ equivalent emission intensity less than 2.2 tonnes of CO₂ per tonne of finished steel (tfs).”

Steel production emissions are typically highest for blast furnace–basic oxygen furnace (BF–BOF) routes, lower for hydrogen-based Direct Reduced Iron (DRI), and lowest for scrap-based electric arc furnace (EAF) routes. Indian manufacturers largely use the blast furnace route.

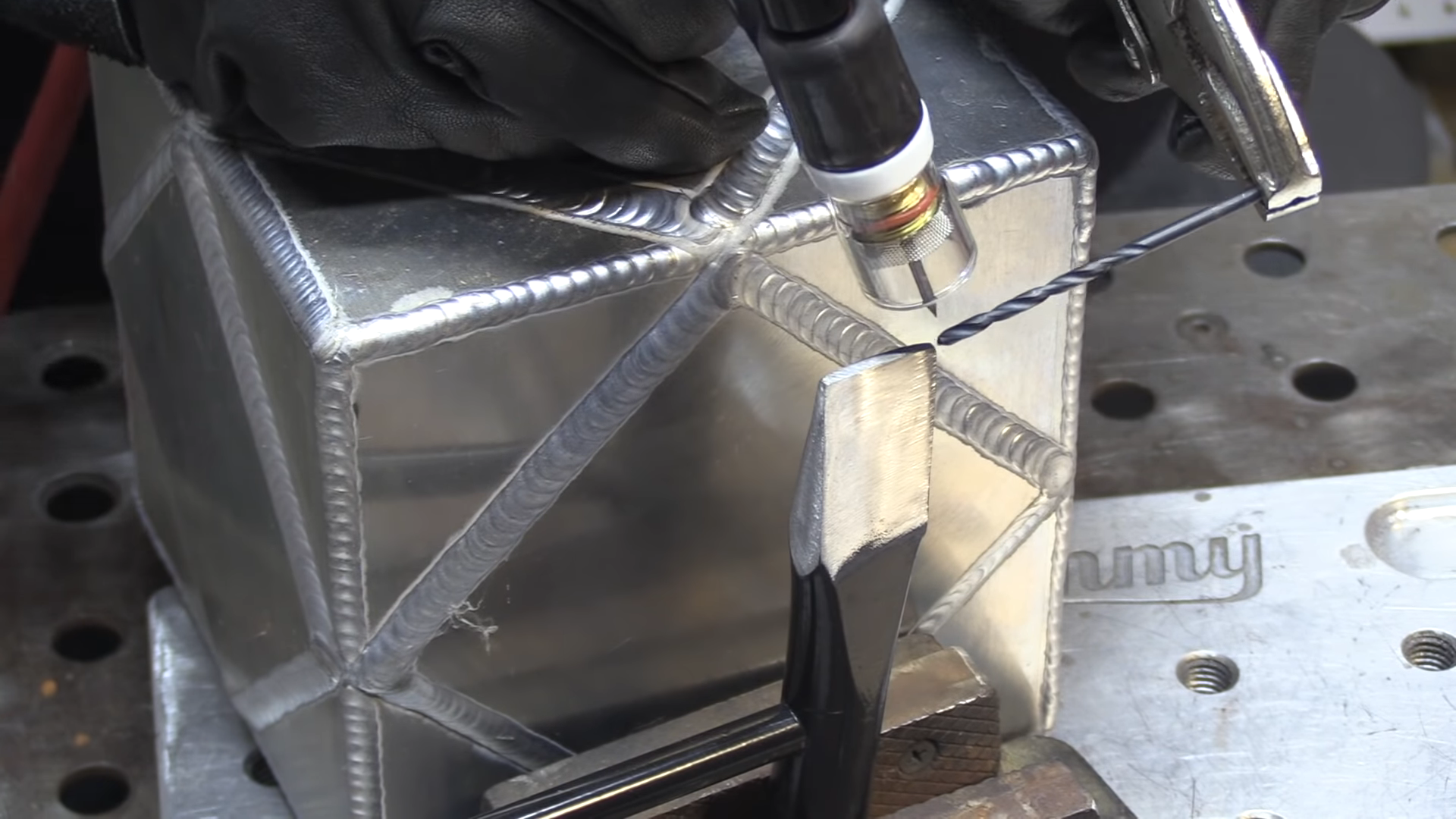

Green steel is produced through low-emission manufacturing processes, such as EAF and DRI, that minimise reliance on fossil fuels. EAF melts recycled steel scrap using electricity rather than coal. A DRI plant produces DRI, also known as sponge iron, by directly reducing iron ore using natural gas or hydrogen. India is the largest producer of coal-based DRI.

Story continues below this ad

In addition to this, integrating renewable energy helps reduce dependence on coal. For the deep decarbonisation of steel, technologies like Carbon Capture Usage and Storage (CCUS) can be utilised, as it is estimated that 56 per cent of the emissions from existing steel production technologies can only be mitigated through the CCUS pathways.

Why decarbonising steel is now a must

As the world’s second-largest crude steel producer after China, India currently exports two-thirds of its steel to Europe. However, India’s steel production still relies on carbon-intensive blast furnace technology, which is clearly incompatible with a trade environment shaped by carbon regulations.

Notably, around 75 per cent of global steel production currently relies on coal-fired blast furnaces, releasing approximately 2 tonnes of carbon dioxide into the atmosphere. This makes the steel manufacturing industry the largest emitter among heavy industries, comprising around 7-9 per cent of total global emissions.

Therefore, countries across the world have been focusing on reducing emissions from steel production and shifting towards ‘green steel’. India has also begun to develop an institutional framework for low-carbon steel production to align with emerging global sustainability norms and its net-zero emissions target by 2070.

Story continues below this ad

The significance of green steel lies in its lower carbon footprint, reduced dependence on fossil fuels, and its role in promoting a circular economy. All these factors are essential for achieving sustainable manufacturing, net-zero goals, and a cleaner environment.

India’s efforts towards decarbonising steel-sector

The steel industry of India accounts for 10-12 per cent of its total emissions. With the rising need for steel, the emissions are rising, too. However, India’s response to rising carbon-related trade pressure has taken the form of a coordinated policy and regulatory framework to decarbonise the steel sector.

In September 2024, the ‘Greening the Steel Sector of India’ report was released, which established a roadmap and targets to reduce emission intensity from 2.65 to 2.20 tonnes of CO₂ per tonne of crude steel by 2029–30. It lays out energy efficiency, material efficiency, renewable energy, process transition, green hydrogen, CCUS, and biomass as the key levers to decarbonise the steel industry.

Following this, the Green Steel Taxonomy for India was released in December 2024, which provides a common language and framework for producing low-carbon-emission steel, drawing in financial support and these incentives. Apart from providing a definition of green steel, it also provides classifications based on emission intensity:

Story continues below this ad

1. Five-star green-rated steel – Steel with emission intensity lower than 1.6 t-CO2e/tfs.

2. Four-star green-rated steel – Steel with emission intensity between 1.6 and 2.0 t-CO2e/tfs.

3. Three-star green-rated steel – Steel with emission intensity between 2.0 and 2.2 t-CO2e/tfs.

This threshold shall be reviewed every three years.

To ensure credibility, the taxonomy is supported by a Measurement, Reporting and Verification (MRV) system, which provides standardised procedures for monitoring emissions and issuing certification. In addition, process transition is another critical element.

Story continues below this ad

As green hydrogen offers a solution for green steel, the Ministry of Steel has sanctioned five pilot projects under the National Green Hydrogen Mission to promote its use in steelmaking. Also, CCUS technologies are being explored to mitigate residual emissions from existing plants.

Yet, the transition towards greener solutions is not easy and faces significant limitations, especially in developing countries like India.

What are the major constraints?

The most prominent challenge is the high cost of low-carbon technologies. Technologies like EAF, hydrogen-based DRI are highly capital-intensive and require huge investment. This may not be economically viable for small and medium-sized steel producers without government support.

Also, the employment of these technologies is still at its nascent stage and requires more focus on research and development to enable major production and uptake in the steel industry. This calls for an industry-academia partnership and financial investment by the government.

Story continues below this ad

Decarbonising steel in India also faces infrastructure constraints. Options like green hydrogen are highly energy-intensive, and producing it needs an immense amount of renewable energy. For this, low land availability is again a crucial challenge.

Further, the under-functioning recycling ecosystem in India is a major hindrance to generating an adequate supply of quality steel scrap, which is one of the critical inputs for low-emission steel production. The Indian recycling industry is largely informal and faces challenges such as poor segregation and processing facilities.

Also, the industrial landscape in India is not yet favourable towards green steel. Due to limited demand, manufacturers are reluctant to invest in greener technologies. All these challenges remain the major hurdles in the decarbonising of the steel sector in India.

Green steel, an opportunity for long-term resilience

The decarbonisation of the steel sector and transition towards green steel need to be understood in the context of the growing global shift towards sustainable manufacturing and production. Major steel-producing countries like China, Germany, and Japan have already been developing policies and strategies for making the steel sector less carbon-intensive. Their experience demonstrates the requirement of state support, focus on research and development, and industry coordination.

Story continues below this ad

In this regard, India has also taken significant steps to transform its steel industry. But it still requires a notable shift in its market ecosystem. Financial incentives in the form of capital subsidies and tax exemptions for companies adopting greener options for steel manufacturing could be the first step. Also, it could set out regulations and mandates for decarbonisation, such as emission-intensity targets and compulsory requirements of renewable energy.

Further, to enhance the availability of high-quality scrap, it is essential for India to overhaul its policies on scrap collection and processing. The scrap usage in steel making in India is 22 per cent, which is lower than the global rate of 33 per cent. India aims to increase scrap share in steel making to 50 per cent by 2047 to aid the green steel initiative. For this, it is crucial to strengthen the scrap quality certification system as well as formalise informal scrap markets.

In addition to this, options such as Biochar (a blend of biomass and charcoal) can diversify India’s options for decarbonisation. Ultimately, green steel must be viewed not merely as a compliance requirement but as an opportunity for industrial upgrading and long-term resilience.

Post read questions

Explain why decarbonising the steel sector has become an economic necessity and environmental obligation for India.

Story continues below this ad

Examine the role of green steel in enhancing the long-term resilience of India’s manufacturing sector. What are the key technological, financial, and institutional challenges in India’s transition towards green steel?

Critically analyse the significance of increasing scrap-based steel production in India’s green steel strategy. How can reforms in scrap collection, processing, and certification support this transition?

Discuss the implications of emerging global sustainability norms and carbon border measures on India–EU trade relations, with special reference to the steel sector. Does the European Union’s Carbon Border Adjustment Mechanism (CBAM) pose both challenges and opportunities for India’s steel sector?

Industrial decarbonisation is closely linked to resource efficiency and circular economy principles. Discuss this statement in the context of scrap-based steel production in India.

(Renuka is a Doctoral researcher at Himachal Pradesh National Law University, Shimla.)

Share your thoughts and ideas on UPSC Special articles with ashiya.parveen@indianexpress.com.

Click Here to read the UPSC Essentials magazine for January 2026. Subscribe to our UPSC newsletter and stay updated with the news cues from the past week.

Stay updated with the latest UPSC articles by joining our Telegram channel – IndianExpress UPSC Hub, and follow us on Instagram and X.