© Worldsteel / Getty Images

Nucor (NYSE:NUE) has delivered strong returns since President Trump imposed tariffs on imported steel last year. The stock has climbed 16% year-to-date in 2026 and gained 41% over the past 12 months, outperforming broader market indices amid protected domestic pricing. Higher tariffs — reaching up to 50% — shielded U.S. producers from cheap foreign imports, boosting revenues for companies like Nucor.

However, reports indicate Trump is now considering scaling back these measures. Officials cite rising consumer prices on everyday goods as a key concern, potentially impacting voter sentiment ahead of midterm elections. If tariffs ease, are steel stocks like Nucor still a buy?

Trump’s Tariff Rollback Plans

According to a Financial Times report, Trump intends to reduce some tariffs on steel and aluminum products. This includes exemptions for certain items, pausing expansions to tariff lists, and initiating more focused national security investigations into specific goods. The moves aim to address complaints that the duties have inflated costs for consumers. For instance, prices have risen for products like pie tins and food and drink cans. Broader tariff hikes last year affected over 400 items, including wind turbines, mobile cranes, appliances, bulldozers, railcars, motorcycles, marine engines, and furniture.

Administration officials from the Commerce Dept. and U.S. Trade Representative’s office argue that these tariffs, used as leverage in trade negotiations, now burden everyday Americans. A Reuters/Ipsos poll shows 59% of Americans disapprove of Trump’s handling of rising costs, highlighting cost-of-living pressures as a political risk for the November midterms. While no specific countries are named for exemptions, the policy shift reflects a response to economic feedback.

Implications for U.S. Steelmakers

Lower tariffs could expose domestic producers to increased competition from imports, potentially pressuring prices and margins. For Nucor, which benefits from the current 50% duties on steel imports, reduced protections might erode the advantages that drove recent gains. Steel imports declined 12.2% in 2025, with recent monthly data showing continued decreases into early 2026.’ If rollbacks proceed, steelmakers may face softer demand or need to cut prices to compete, impacting profitability.

Recent market reactions underscore these risks. Shares of Cleveland-Cliffs (NYSE:CLF) dropped nearly 17% on Monday following a Q4 revenue miss of $4.31 billion against expectations of $4.6 billion. The decline deepened after CEO Lourenco Goncalves sold 3 million shares worth over $37 million on Wednesday. Yet as legendary investor Peter Lynch has noted, insiders can sell stock for any reason, but purchases signal confidence in future growth. Investors should view such events as background noise and focus more on a business’s fundamentals.

Despite these pressures, some positives remain for the sector. Demand from data centers and infrastructure projects could offset import challenges, and there is still a market with electric vehicles, though it is much weakened these days.

Nucor, with its efficient mini-mills and scrap recycling, maintains low production costs, positioning it better than its peers. The company’s recent 8.6% revenue growth to $7.7 billion demonstrates its resilience.

Key Takeaway

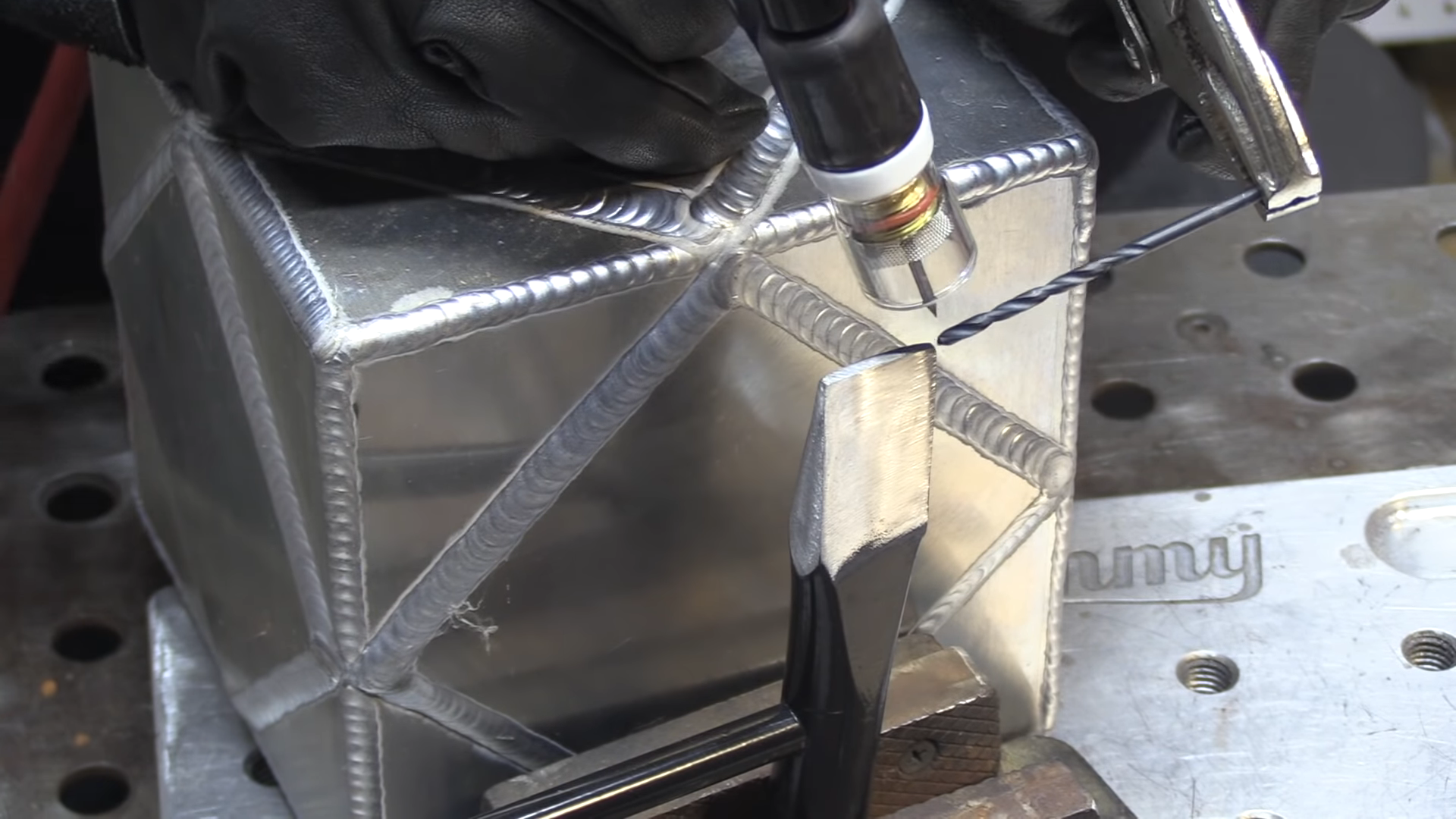

Before stepping away from Berkshire Hathaway (NYSE:BRK-A)(NYSE:BRK-B) at the end of last year, Warren Buffett added a significant position to his long-standing Nucor holdings, purchasing about 6.6 million shares for roughly $850 million. He has owned the stock since the 1990s, first attracted by Nucor’s innovative electric arc furnace technology. The current buy came after the stock hit a low of $97 amid recession fears, reflecting Buffett’s value-oriented approach, but the stake underscored his confidence in Nucor’s fundamentals.

However, the potential for tariff reductions introduces short-term uncertainty, possibly leading to a decline in Nucor shares (they are falling 6% in morning trading today). Yet, the company’s strong balance sheet, with $5 billion in cash, supports ongoing buybacks, and it recently made its 210th consecutive quarterly dividend payment — that’s over 52 years. Expansions through a $6.5 billion capital plan through 2027 target high-margin areas, including green steel initiatives.

These factors suggest Nucor remains a solid long-term holding, even if tariffs ease, due to its cost advantages and exposure to growing sectors like renewables and tech infrastructure.

If You have $500,000 Saved, Retirement Could Be Closer Than You Think (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality. (sponsor)