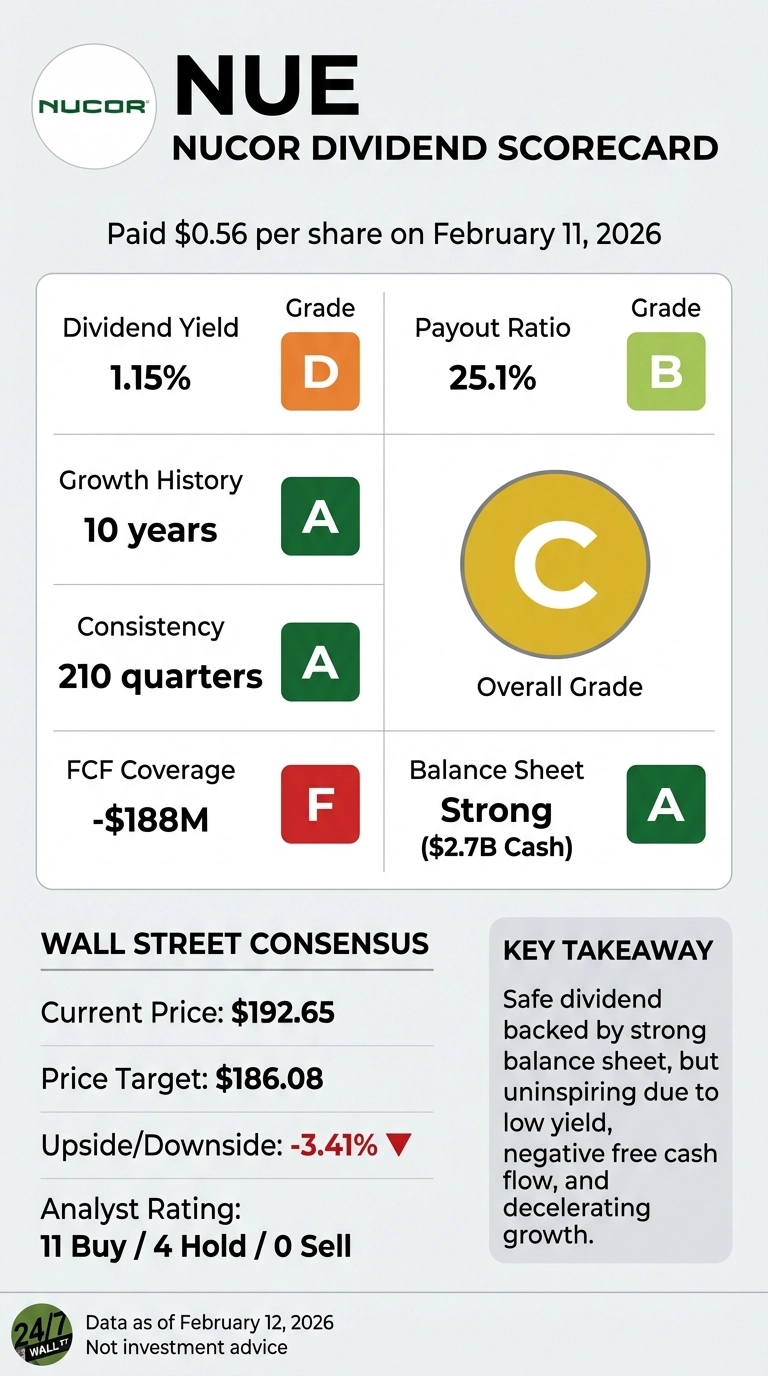

Nucor Corporation just paid investors $0.56 per share on February 11, 2026, marking the company’s 210th consecutive quarterly dividend. But behind this impressive streak lies a troubling reality: the steelmaker is burning through cash faster than it’s generating it, raising questions about how long this dividend can maintain its steady growth trajectory.

The Numbers Behind the Latest Payment

The $0.56 quarterly dividend represents a modest 1.82% increase from the $0.55 paid in Q4 2024. For the full year 2025, Nucor distributed $2.21 per share, up just 1.84% from 2024’s $2.17. This marks a significant deceleration from the 4.83% growth recorded between 2023 and 2024.

At the current stock price of $192.65, the dividend yields just 1.15%, placing it well below the S&P 500’s average yield and making it one of the least compelling income plays in the steel sector.

Cash Flow Reality: The Warning Sign Investors Can’t Ignore

Here’s where the dividend scorecard turns concerning. Nucor generated $3.23 billion in operating cash flow during fiscal 2025, but capital expenditures consumed $3.42 billion. The result? Negative free cash flow of $188 million, the first time in the available dataset that Nucor has failed to generate positive free cash flow.

This represents a dramatic reversal from just two years ago, when the company produced $4.90 billion in free cash flow in fiscal 2023. Operating cash flow has plunged 68% from its fiscal 2022 peak of $10.07 billion.

Despite this cash crunch, Nucor paid out $512 million in dividends during 2025, meaning the company had to tap its balance sheet to fund both its dividend and its capital spending program. The dividend now consumes 25.1% of net income, up sharply from just 5.3% during the profitable 2022 fiscal year.

The Cyclical Downturn Hits Hard

Steel manufacturing is brutally cyclical, and Nucor is experiencing the downside of that cycle. Net income tumbled to $2.04 billion in fiscal 2025, down 12.1% from 2024 and a staggering 75% below the $8.08 billion earned in fiscal 2022.

Recent quarterly results show the volatility. Operating cash flow swung from a weak $364 million in Q1 2025 to $1.34 billion in Q3 2025, before settling at $799 million in Q4 2025. This unpredictability makes it difficult to project sustainable dividend coverage going forward.

The company’s management has responded by scaling back share repurchases to $700 million in fiscal 2025, down from $2.22 billion the prior year, suggesting they’re prioritizing cash preservation.

Balance Sheet Strength Provides a Cushion

The saving grace is Nucor’s fortress balance sheet. The company ended Q4 2025 with $2.70 billion in cash and maintains a $2.25 billion undrawn credit facility. Shareholders’ equity stands at $22.12 billion, providing substantial cushion to weather cyclical downturns.

This financial strength explains why the dividend remains safe in the near term, even with negative free cash flow. The company can easily fund dividends from its cash reserves while waiting for the steel cycle to turn. Management’s commitment is evident in the fact that they’ve paid 210 consecutive quarterly dividends and returned approximately $1 billion to shareholders year-to-date through 2025, representing more than 70% of net earnings.

Growth Trajectory Shows Deceleration

Nucor’s dividend growth story has lost momentum. The 10-year compound annual growth rate of approximately 4.9% looks respectable, but recent years tell a different story. The 1.84% growth in 2025 barely kept pace with inflation and represents a significant slowdown from mid-single-digit growth rates earlier in the decade.

Looking at the quarterly pattern, the company held the dividend flat at $0.55 per share for Q1 through Q3 2025 before bumping it to $0.56 in Q4. This conservative approach reflects management’s awareness of the challenging operating environment.

Insider Activity Raises Yellow Flags

Recent insider transactions add another layer of concern for dividend investors. Between November 14, 2025 and February 12, 2026, company insiders executed 15 disposal transactions compared to just 2 acquisitions — an 88% selling ratio.

Most notably, CEO Leon Topalian sold 5,000 shares at $157.99 on December 19, 2025, while CFO Stephen Laxton disposed of 6,979 shares at $157.11 on December 22, 2025. While some of this activity appears to be routine option exercises and tax planning, the absence of any insider buying during this period suggests management isn’t signaling high confidence through equity purchases.

Valuation Reflects Dividend Limitations

The market is pricing Nucor at 26x trailing earnings and 17x forward earnings, elevated multiples for a cyclical industrial company with a sub-2% dividend yield. The stock has surged 46.62% over the past year and 18.11% year-to-date, driven more by expectations of a cyclical recovery than by income appeal.

This valuation suggests investors are betting on earnings growth and steel price recovery rather than dividend income. At 1.15%, the yield offers little compensation for the cyclical risk inherent in steel manufacturing.

The Economic Backdrop: A Potential Tailwind

One positive factor is the broader economic environment. U.S. GDP growth accelerated to 4.4% in Q3 2025, recovering sharply from a 0.6% contraction in Q1 2025. This strong economic momentum typically supports industrial demand and steel consumption, which could help Nucor’s cash generation improve in 2026.

Management has signaled optimism, expecting increased Q1 2026 earnings across all segments driven by higher volumes and prices. If this guidance proves accurate, the cash flow picture could improve significantly, restoring positive free cash flow and making the dividend more sustainable.

The Verdict: Safe But Uninspiring

Nucor’s dividend earns a mixed grade. The 210-quarter payment streak and strong balance sheet ensure near-term safety, but the combination of negative free cash flow, decelerating growth, and a below-market yield makes this an uninspiring income investment.

The dividend is sustainable because Nucor can fund it from cash reserves and operating cash flow, even without positive free cash flow. The 15.8% payout ratio relative to operating cash flow provides adequate coverage. However, dividend growth investors should temper expectations. Until steel prices and volumes recover meaningfully, expect continued low-single-digit increases at best.

For investors seeking reliable income, the 1.15% yield simply doesn’t compensate for the cyclical volatility. The stock price appreciation of 46.62% over the past year suggests the market is already pricing in a recovery, leaving limited upside for late arrivals.

The dividend is safe but not compelling. Nucor remains a quality company with a long-standing commitment to returning cash to shareholders, but current conditions argue for patience. Income-focused investors would be better served waiting for either a meaningful yield expansion or clearer evidence that free cash flow has turned sustainably positive before making Nucor a core dividend holding.

If You’ve Been Thinking About Retirement, Pay Attention (sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance, and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor. Here’s how:

- Answer a Few Simple Questions.

- Get Matched with Vetted Advisors

- Choose Your Fit

Why wait? Start building the retirement you’ve always dreamed of. Get started today! (sponsor)