Have you checked your commodity price charts today? The charts are trying to tell you a story of what’s been happening in the markets – and perhaps what may happen next.

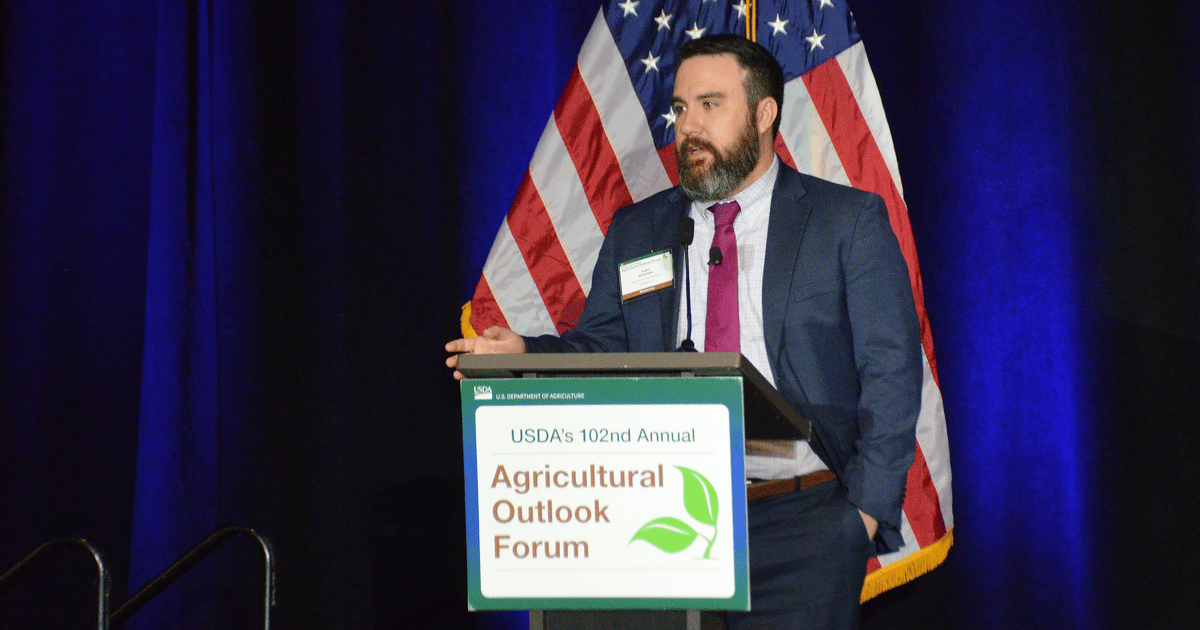

That’s why farmers should keenly watch futures charts for key ag benchmarks such as corn, soybeans and wheat. Even if you don’t trade futures, keeping a close eye on the charts could help reveal market inflection points, highlight important trends and inform hedging and marketing strategies, said Brian Splitt, chief strategist for AgMarket.Net.

“The chart is really just a visual representation of the price behavior of each individual market,” Splitt said in an interview with Farm Futures. “And within those price patterns, there is historical evidence of certain patterns” that could signal certain outcomes.

“At the very least, we can identify what the trend of a market is,” Splitt said in an interview with Farm Futures at his firm’s annual “Farming for Profit, Not Price” conference in Nashville on February 2. “Is it up, is it down, is it sideways? And then maybe we can identify some patterns within those trends to help us get an idea of where prices may be in the future. A lot of my option structures are based on how I view the chart.”

Splitt took a closer look at one futures chart that will become increasingly important for U.S. farmers as the spring planting and growing season evolves: new-crop December 2026 corn.

December 2026 corn in “happy place”

The contract bottomed last August around $4.40 per bushel and, even after a couple of late-2025 rallies, has largely held a sideways pattern, with the high end in the low-$4.70s. Whether December corn sustains that roughly 30-cent range in the months ahead bears close watch, Splitt said.

“We’ve had maybe a handful of pops” higher to the $4.70 area in recent months, Splitt said, “But all of those events were very short-lived … and we inevitably found ourselves back into that trading range very shortly after. So, the story this chart is telling me is that the market is very ‘happy’ in this trading range.”

As the market gains more information — about farmer planting intentions, spring weather and seeding progress, export demand and other key fundamentals — December corn has the potential to probe the high and low ends of that range, and perhaps even break through.

Splitt will be watching the $4.40 and $4.70 levels closely and suggests farmers contemplate marketing strategies that consider the implications of moves above or below those prices.

“I think you have to have a structure in place where you have a worst-case scenario established,” Splitt said. “A move below $4.40 in the big picture is not going to be a good development (for farmers). If we can get through $4.70, maybe we can see some better pricing opportunities. A lot of my new crop hedging structures are based on the trading range that we’re in currently.”

“I want to have unlimited downside coverage into next fall in case we do have good weather and a large crop again,” he added. “But I also want to have the ability to take advantage of upside potential if this market breaks through what I would call continuous resistance near $5.”

On Feb. 13, December 2026 corn ended at $4.64½, the contract’s highest closing price since Jan. 8. The contract has rallied over 19 cents, or 4.3%, from a mid-January low.

To hear directly from Splitt, watch this Ag Marketing IQ video.