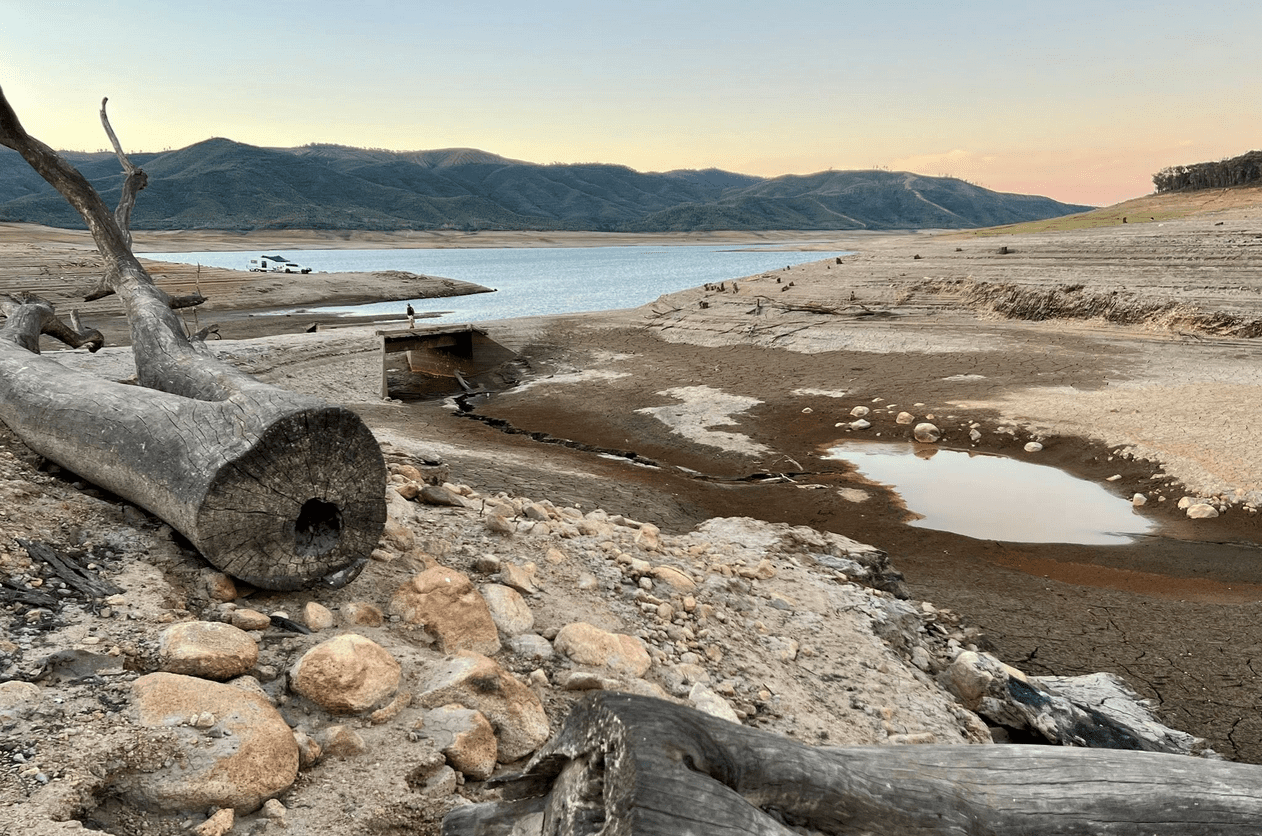

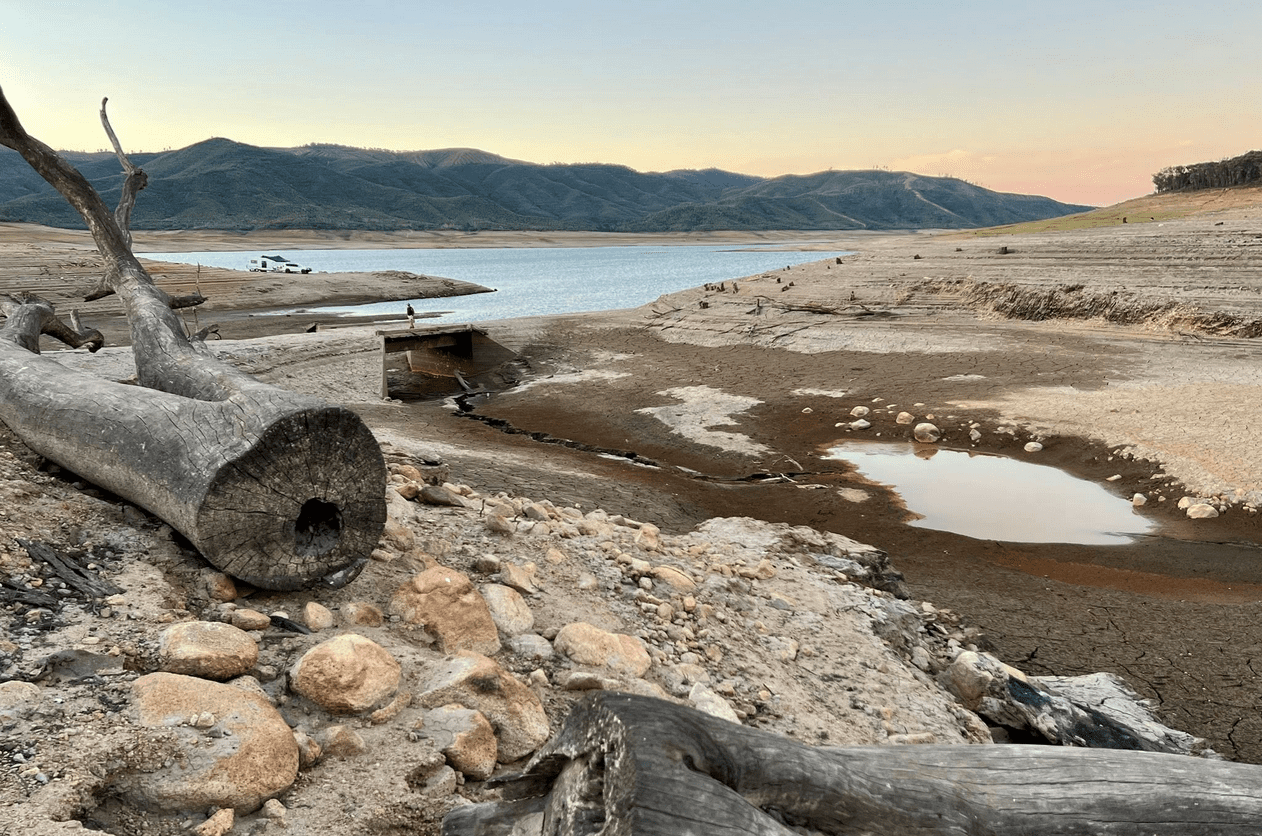

The Yachting Point campground at Blowering Dam is a long way from water now that the storage’s level is down to 22pc. Photo: Live Life Now Adventures

THE HIGH cost of temporary water has bitten into corn area in the Murrumbidgee and Murray valleys, and corn prices have risen by around 30 percent since planting in spring.

This rally also reflects limited carry-out from the crop grown over last summer, much of which sold into the Victorian and southern New South Wales drought market last autumn and winter.

Rice and cotton area has also been impacted, and some irrigators are looking at carrying over unused permanent allocation to get their winter crops going, or grow fodder that can be value-added with grazing to supply buoyant livestock markets.

Stored water low

The Murrumbidgee Irrigation Area is the heartland of Australia’s irrigated rice production, and also a major cotton-growing region; together with the Murray Valley, it grows much of Australia’s irrigated corn.

Across the valleys, high-security water allocations currently stand at 95-97 percent, against general-security allocations of 32pc in the Murrumbidgee and 20pc in the Murray.

This limited availability reflects low levels in the rivers’ three major storages — Burrinjuck at 38pc and Blowering at 22pc for the MIA, and Hume for the Murray at 27pc.

It also demonstrates the strength of demand from permanent plantings including almonds, and the Federal Government’s ongoing buyback to bolster environmental flows which is reducing the amount of water available in the spot market.

NSW Government records show Blowering and Burrinjuck, as major sources of water heading down the Murrumbidgee, got down to 24pc and 30pc respectively during the 2017-2020 drought, and general-security allocations fell to zero in 2019.

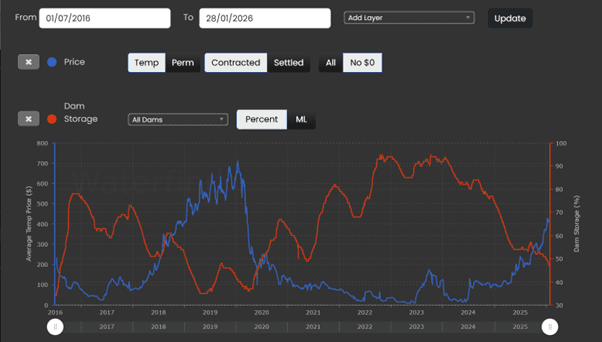

Waterfind managing director Tom Rooney said temporary water has not cost this much since 2018, in the midst of the NSW drought.

“On temporary water, 60-80pc of value changes are all around dam storages and allocations between all the classes,” Mr Rooney said.

“The heaviest correlation is to dams, and they’re heading into 2018 territory.”

Waterfind data indicates temporary Murrumbidgee water has risen from around $30/ML in early 2024, when combined storages were at a decade high of 93pc, to more than $420/ML on January 28, with storages overall below 50pc.

Murrumbidgee public storage levels in red against the temporary water per megalitre price from July 2016 to January 2026 in blue. Source: Waterfind

Rice area appears to be hardest hit.

In its summer-crop snapshot released last week, Digital Agricultural Services said rice area was “far lower than normal” at around 11,000ha planted.

This compares with a typical 40,000-50,000ha rice area, and is below the most recent ABARES forecast released December 4 of 17,000ha.

“DAS attributes this to reduced water allocations across the Murray and Murrumbidgee river systems,” the snapshot said.

Corn hots up

DAS observations put all of NSW’s corn area at 27,000ha, around 35pc lower than last season, against ABARES December 4 estimate of 20,000ha for both the current and previous seasons.

While ABARES has Victorian corn area at 6000ha in both seasons, DAS puts the current planted area at 12,600ha.

“[This] is around 28pc lower than last season, with the decline concentrated in key northern irrigation districts,” the DAS snapshot said of Vic plantings.

One trade source estimates the Murray and Murrumbidgee corn area overall to be 30pc down on last year, and said the domestic feed market has already reacted.

“Maize inclusion in domestic feed rations will also be down as energy and metabolisable energy do not correlate to its price versus wheat and barley.

“Even dairy farmers, who are consistent buyers of maize, are switching to wheat and barley due to price disparity.”

With both winter cereals available at below $300/t, that equates to a discount of more than $200/t to corn.

ABARES forecasts NSW corn production from the upcoming harvest at 182,000t, down only 3000t from last season, and the Vic crop at 63,000t, down 1100t.

However, industry sources see both those figures as overdone, particularly after a windy and challenging start for corn in both valleys, and some fierce heat and wind in December-January.

Grower experience

Barooga grower and Murray irrigator Josh Wright has dropped around one third of his corn area this year due to the high price of water and relatively low price of corn at planting time in spring.

“The temporary market now is $340-$350ML; for the early sown crop, we bought water for $220, and last year it was trading for $110-$130,” Mr Wright said.

The stronger water market reflects the change from last summer, when the Wrights had full allocation on their low-security water, to this summer, when their allocation is down to 20pc.

Corn prices have gone the opposite direction.

“At the time of planting…our first contract was at $370/t ex farm for 1000 tonnes, and then we committed to more at $430/t.”

Pacific Seeds territory manager Dan Rolls, Barooga farmer Josh Wright, and Pacific Seeds summer grains agronomist Chris Gillam with an irrigated crop of the PAC500 which will be sold into the feed corn market. Photo: Pacific Seeds

Anecdotally, other growers have recently forward sold corn at $475/t.

The Wrights budget on 8ML/ha for irrigated corn, and target yields of 16t/ha for long-season area, and 14t/ha on double-cropped country.

This summer, they have 180ha in the ground, including 75ha of long-season PAC 500, with the balance being shorter-season varieties double-cropped after canola.

They have no livestock, and grow a wheat-canola winter rotation, sometimes with faba beans too.

Mr Wright said corn area over next summer is possible but not assured.

“If corn’s worth what it’s worth, and water’s worth what it’s worth, we’ll have to see.”

Less thirsty options sought

“There’s definitely a reduction in corn and the rice due to, at planting, the increased price of water,” Nutrien Ag Services Deniliquin branch manager Matt Tubb said.

“With the available corn price, and the water cost, growers decided not to put as much area in, or any area at all.”

Lucerne, active from now until April-May, ryegrass pastures, and grazing or dual-purpose brassicas or cereals are all attracting increased interest for their lower water needs when compared with irrigated cash crops.

“Definitely there’s an interest from growers that have got businesses set up to handle livestock; they will look at producing fodder.”

While plenty of farmers in the wider Murray Valley like Mr Wright have no intention of reintroducing livestock to the family farm, Mr Tubb said others are looking at upping their numbers.

“There’s probably a scenario where there were a lot of people going away from sheep and cattle in recent years, but markets have been pretty reasonable, and…a few people may be doing small areas of irrigated pastures.”

“There are quite a few that will sow pastures and cross fingers and toes for rain in April.”

Grain Central: Get our free news straight to your inbox – Click here