Tata Steel Ltd reported a 15% year-on-year rise in consolidated Ebitda, adjusted for forex translation, to ₹8,200 crore in the December quarter (Q3FY26), even as revenue grew a more modest 6% to ₹57,000 crore. Lower raw material costs, gains from cost-takeout initiatives and higher volumes helped offset continued losses in the UK operations.

On a standalone basis, revenue rose 9% to ₹35,600 crore. Volumes climbed 14%, but average realizations fell 4.5%, limiting adjusted Ebitda growth to 5% at ₹7,900 crore. Ebitda per tonne declined 8% to ₹13,090.

The outlook for the March quarter (Q4) is stronger, supported by higher domestic steel prices following the imposition of safeguard duty in December. Management expects realizations to improve by about ₹2,300 per tonne in Q4, partly offset by a $15 (around ₹1,350) per tonne increase in coking coal prices. Volume growth is expected to remain in line with Q3.

Global triggers

Europe could provide a pricing lever from the second half of the year. The European Union’s carbon border adjustment mechanism (CBAM) took effect on 1 January, requiring importers to purchase carbon certificates on steel shipments. A nearly 50% cut in tariff-free steel import quotas and a higher import duty of 50%, from 25% earlier, will come into force on 1 July.

Following these changes, European steel prices are expected to improve. Nuvama Institutional Equities has raised its FY27 and FY28 Ebitda estimates for Tata Steel by 5% and 7%, citing higher steel prices and improved profitability in the Netherlands.

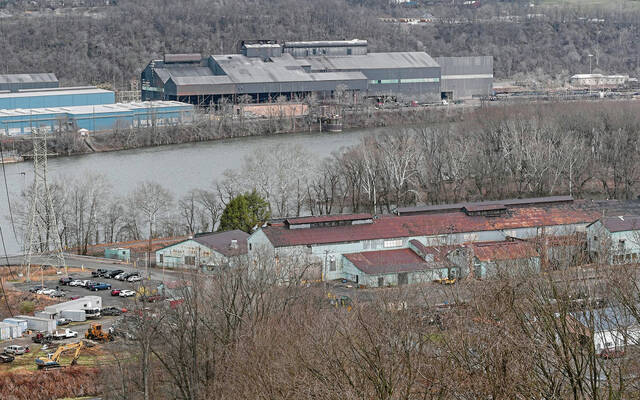

The UK may also move to impose safeguard measures to protect its domestic steel industry, which remains under severe financial stress. The UK government took control of two steel plants in 2025 to prevent their closure. Tata Steel management has said spreads would need to rise by £100 per tonne (about ₹12,300) for its UK operations to turn profitable.

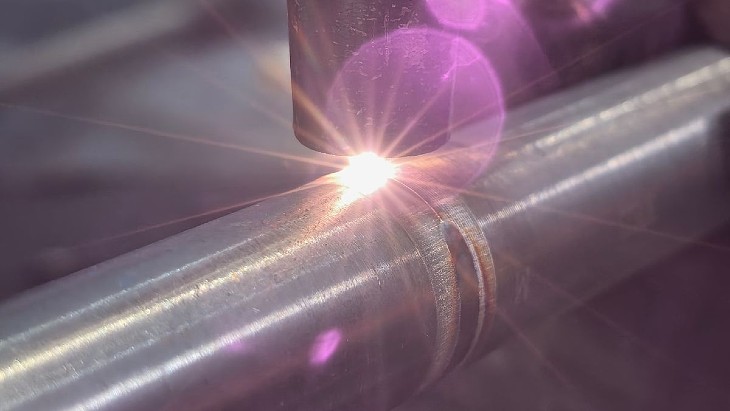

Back home, Tata Steel’s 0.75 million tonnes per annum (mtpa) plant at Ludhiana is expected to be commissioned next month. Larger expansion plans totalling 7.3 mtpa are slated for FY30. “Post-FY27, Tata will log 2-3% volume growth, as benefits of next phase of expansion shall accrue FY30 onwards,” Nuvama said.

The imposition of interim safeguard duty in April 2025 has helped Tata Steel’s shares gain nearly 50% over the past year. The stock trades at about 7.4x its FY27 estimated Ebitda, based on brokerage estimates. Price trends in Europe and policy developments in the UK are likely to shape the stock’s trajectory going ahead.