Olympic Steel, Inc. and Ryerson Holding Corporation announced the finalization of the two companies’ merger to promote growth between the two on Feb. 13.

“We just think we have an obligation to continue to grow, and this exhilarates our opportunities to continue on the path from 1954 till today to really have explosive growth as we look forward from 2026,” Michael Siegal, former executive chairman of Olympic Steel’s board of directors and now appointed chairman of Ryerson’s board of directors.

As a part of the merger, which began discussions in August 2025, Siegal, a congregant of Park Synagogue in Pepper Pike, said Olympic Steel negotiated about 1.7105 shares of Ryerson for every share of Olympic Steel, and former shareholders of Olympic will hold about 37% of Ryerson.

Brothers Sam and Sol Siegal founded Olympic Steel in 1954, conducting business in a rented warehouse in Cleveland. Now the metal service provider has 53 sales and warehouse locations in America, with a manufacturing footprint of more than 4.5 million square feet, according to Olympic Steel’s website. Olympic Steel is based in Bedford Heights.

Ryerson, found in 1842 and based in Chicago, and its 43,000 employees and 110 locations has become a leading processor and distributor of industrial metals, according to Ryerson’s website.

For the New York Stock Exchange, the joint company will trade under the ticker “RYZ,” starting on Feb. 24. The company is expected to produce about $120 million in annual synergies by early 2028 from procurement, scale, efficiency gains, commercial portfolio enhancements and footprint optimization, according to a news release from Ryerson.

When the companies entered a definitive agreement to merge on Oct. 28, 2025, the merged company was valued at an estimate of $6.5 billion, according to the release.

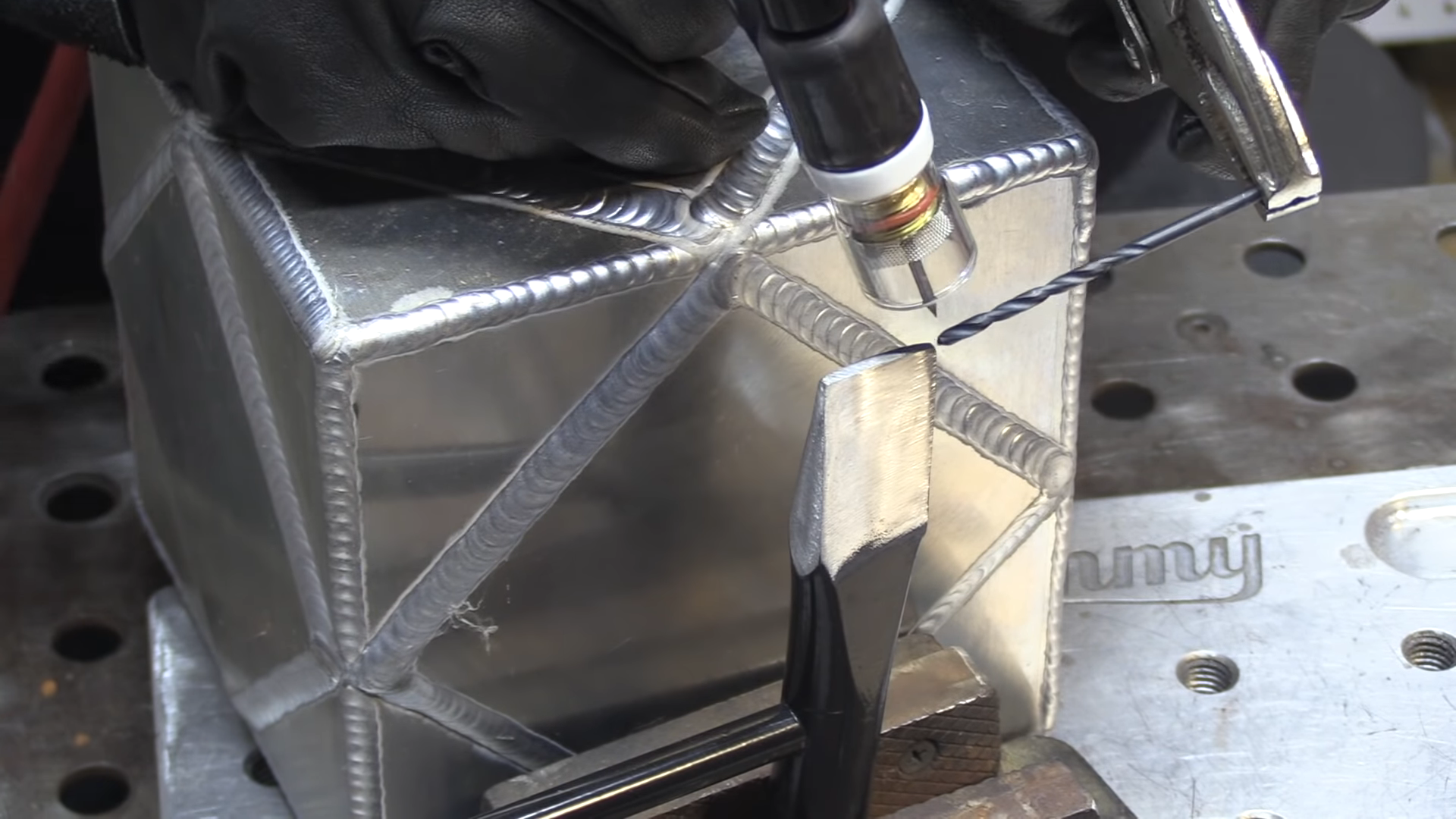

Siegal said that Olympic Steel will have a wider customer reach, service more geographic locations and add more products to its portfolio as Ryerson has a “more full basket of products” that Olympic Steel doesn’t handle.

“If we provide excellence service, you can’t double excellence,” he said. “I would hope customers see the same kind of service, and I hope that customers also now recognize the fact that we can service them with more products than we presently do.”

Eddie Lehner will continue as CEO of Ryerson. Richard T. Marabito, former CEO of Olympic Steel, was appointed as president and CEO of Ryerson.

Richard A. Manson, former chief financial officer of Olympic Steel, will serve as senior vice president of finance for Ryerson and will lead the transition and synergy attainment efforts. Andrew Greiff, former president and chief operating officer of Olympic Steel, will become executive vice president of Ryerson and president of Olympic Steel.

Olympic Steel board members Richard P. Stovsky, Peter J. Scott Marabito will join an 11-member board composed of the two companies.

Siegal said that he hopes shareholders will understand how beneficial the merger will be to them and the companies as they are both “like-minded and value-run organizations.”

“The merger creates a much bigger footprint with no additional debt, which then should increase our market caps by a significant amount which is a better retreat on invested capital for the shareholders and creates more opportunities of growth for our employees,” he said. “It’s opportunity, growth and value.”